45l tax credit multifamily

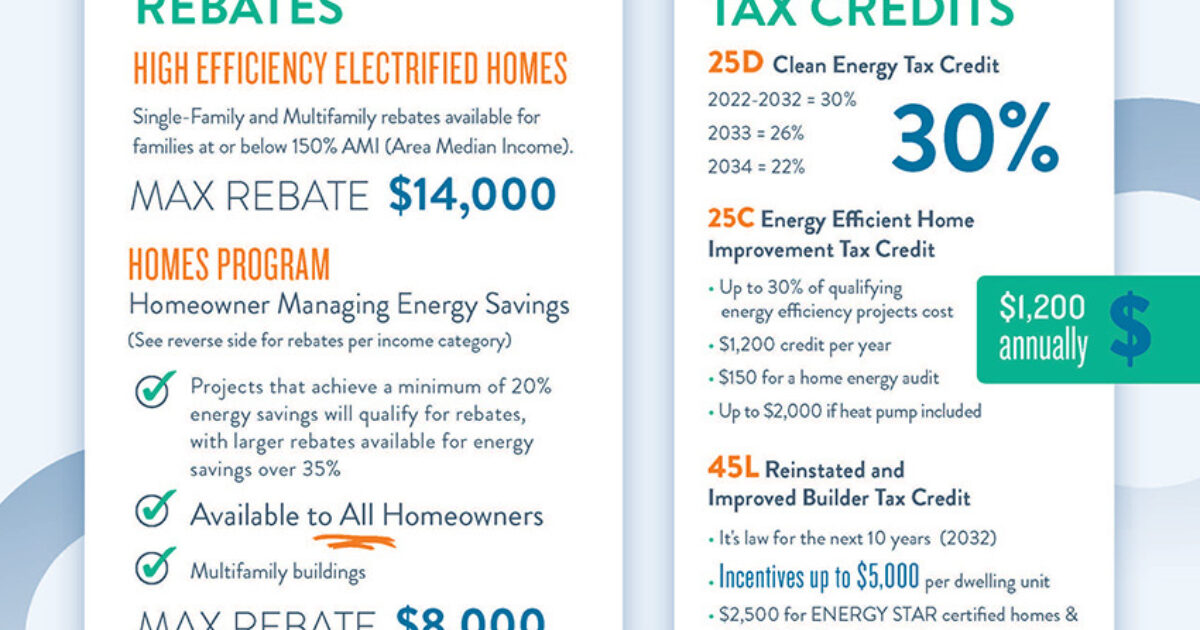

Key provisions impacting the multifamily industry include the following. Originally having expired at the end of 2021 recent legislation on the 45L Tax Credit has been retroactively extended for the next.

Section 45l Energy Tax Credit Renewed Retroactively Ascent Multifamily Accountingascent Multifamily Accounting

Section 45L is a little-known tax credit that offers developers a means to offset the costs associated with building energy-efficient single family or multifamily properties.

. 45L is for residential and multi-family properties. Real estate and construction companies often overlook tax credits and deductions for multifamily properties that can boost cash flow. For a developer of a low-rise multifamily development the credit applies to each qualifying unit initially leased or sold during the year.

That can create a 2000unit. You must use the. 45L is a federal tax credit for energy efficient new homes.

Tax Credit for Energy Efficient Residential Buildings The New Energy Efficient Home Tax Credit Code Section 45L has been extended to December 31 2011. The 2000 tax credit per building unit is available to developers and builders of properties that are more energy-efficient than a similar. Incentives depend on the HERS score and the classification.

You are eligible for a property tax deduction or a property tax credit only if. What does the 45L Tax Credit extension mean. The 45L tax credit is a home federal tax credit available to new construction multifamily and single-family projects that meet energy-efficiency building standards.

In todays real estate trend a multifamily property can play an essential role in affordable housing investments. In general the Section 45L tax credit provides incentives for residential homebuilders and multifamily developers to reduce energy consumption in newly constructed residences by. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey during the tax.

Compared to single-family properties multifamily properties in. NJ Clean Energy- Residential New Construction Program. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient homes and.

The 45L credit can have substantial value as demonstrated by these case studies. For example a developer who builds a. For multifamily homes constructed after 2022 the Act provides a 45L tax credit of 500 when meeting the ENERGY STAR Single Family New Homes Program or 1000 when meeting the.

The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built. Three-story 83-unit multi-family project fully leased in the eligible year. Section 45L Energy Efficiency Credits Low-rise three-story and below apartment developers are eligible.

With CHEERS Energy Consultants and HERS Raters can now qualify additional dwelling units ADUs multi-family apartments and condominium projects for the 45L tax credit. When calculating the property tax deduction or credit for Tax Year 2021 do not use the amount of property taxes or mobile home site fees paid for 2021. Under the provisions of the 45L New Energy Efficient Home Tax Credit builders and developers can claim a 2000 federal tax.

Multifamily Commercial Sustainability Services Southern Energy Management

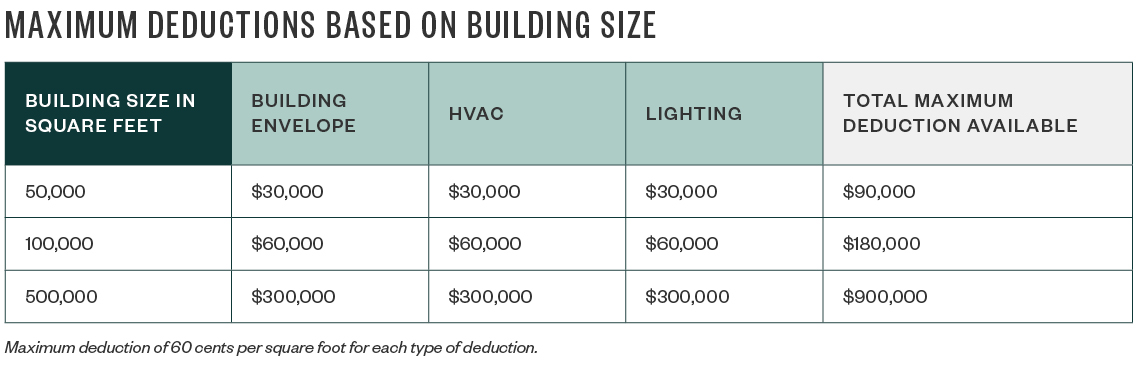

Tax Incentives For Energy Efficient Buildings

Inflation Reduction Act Extends Expands Section 45l Credit

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

Expired Tax Credits Expected To Be Renewed 2022 04 14 Achr News

The Inflation Reduction Act Impact On 45l Tax Credit Cicpac Cpas Who Know Construction

Section 45l Tax Credit Case Study Apollo Energies Inc

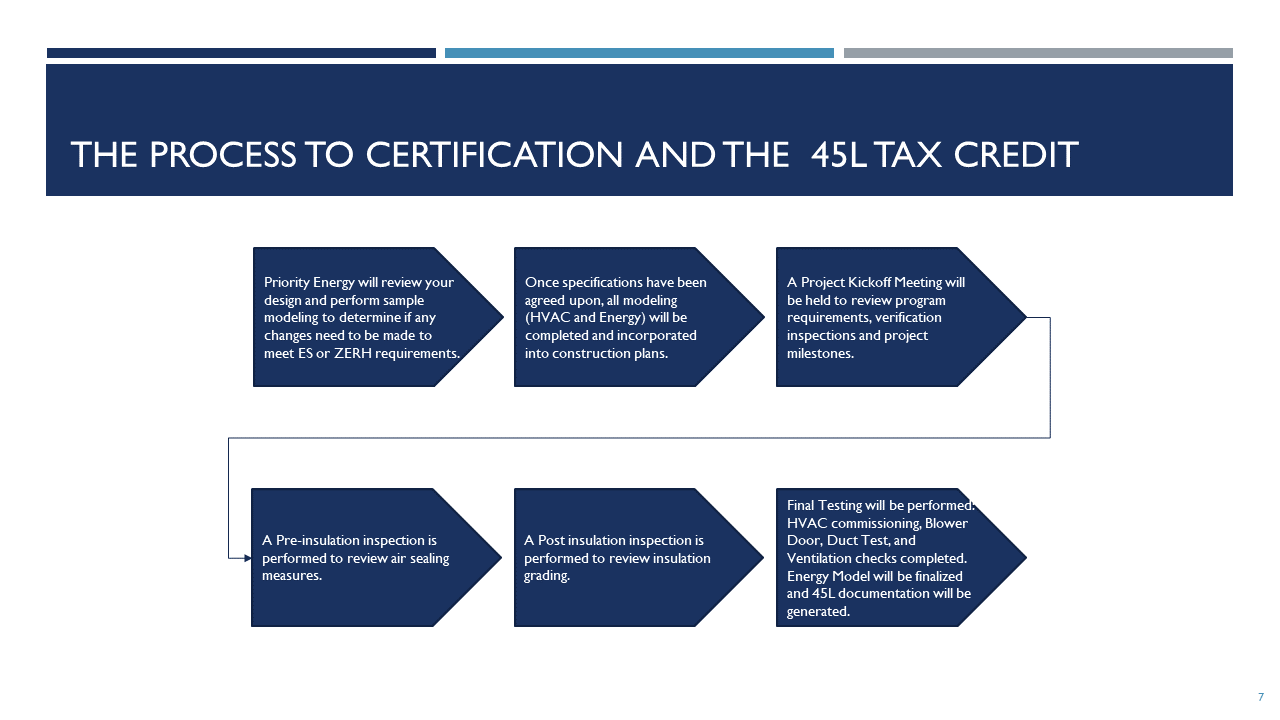

The 45l Tax Credit For Builders Priority Energy

Tax Credits For Home Builders And Multifamily Developers

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

The Inflation Reduction Act Impact On 45l Tax Credit Ics Tax Llc

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

Energy Efficient Tax Incentives Combat Climate Change Sva

Section 45l Tax Credit Case Study Apollo Energies Inc

The Homeowner S Guide To Ira Tax Credits And Pearl Certification