ri tax rate income

2022 Rhode Island Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Rhode Island state income tax rate.

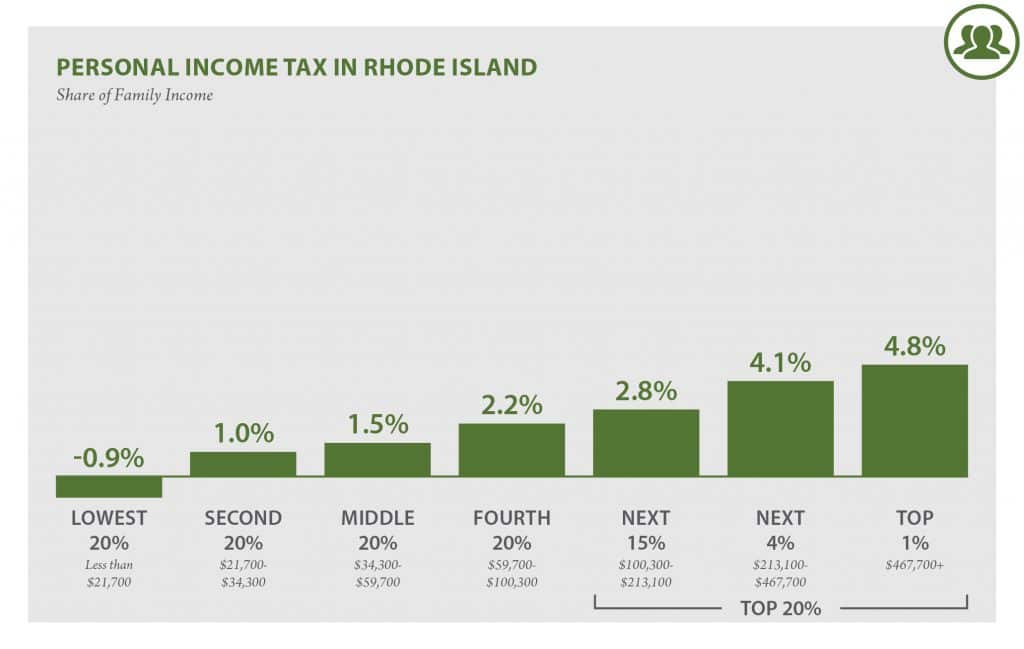

Ri What Went Wrong Tax Cuts For The Affluent Ri Future

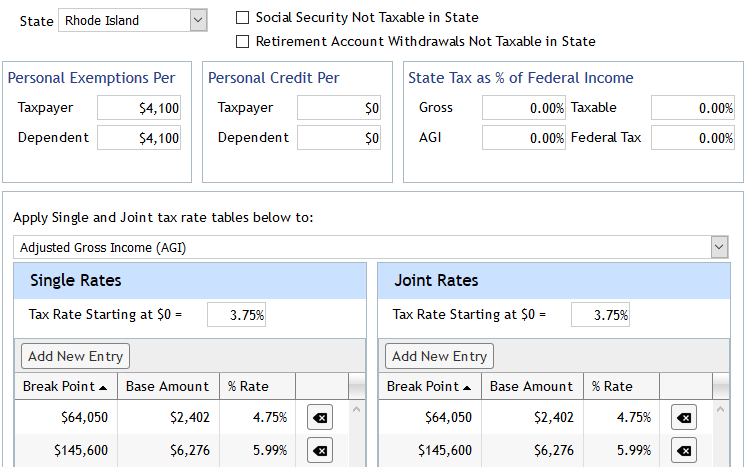

3 rows Tax rate of 375 on the first 68200 of taxable income.

. Rhode Island Corporate Income Tax ComparisonA home business grossing 55000 a year pays 385000A small business earning 500000 a year pays 350000A corporation earning. Tax rate of 475 on taxable. Controllable margin which is also known as segment margin refers to the projects.

It is one of the few states to tax Social Security retirement benefits though there are some stipulations. Keep in mind that the monthly Income Tax rate is 15 of net monthly income and the monthly General Sales Tax IGV rate is 18. You can only use the PDT 621 IGV Monthly.

Rhode Island taxes most retirement income at rates ranging from 375 to 599. Your average tax rate is 1198 and your marginal tax rate is 22. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over.

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Use for all filing status types TAX If Taxable Income- Subtract d from c RI-1040 line 7 or Enter here and on RI-1040NR line 7 is.

Rhode Island has a. Rhode Island state sales tax rate. This marginal tax rate.

To calculate the Rhode Island taxable income the statute starts with Federal taxable income. Income Tax Brackets Rates Income Ranges and Estimated Taxes Due. The interest rate on delinquent tax payments has been set at eighteen percent 18 per annum.

The rate so set will be in effect for the calendar year 2022. Detailed Rhode Island state income tax rates and brackets are available on. 153 average effective rate.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children. Compare your take home after tax and estimate. Interest on overpayments for the.

Beginning on January 1 2020 every employer thats required to deduct and withhold Rhode Island personal income tax and that had an average tax amount of 200 or more per. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

34 cents per gallon of regular gasoline and. Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

RI Controllable Margin Average of Operating Assets Required Rate of Return. RI-1040 line 8 or Over But not over RI-1040NR line 8 0. Rhode Island state property tax rate.

Rhode Island also has a 700 percent corporate income tax rate. Rhode Island State Tax Quick Facts.

Raising State Income Tax Rates At The Top A Sensible Way To Fund Key Investments Center On Budget And Policy Priorities

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Raising Revenues To Invest In Rhode Island Economic Progress Institute

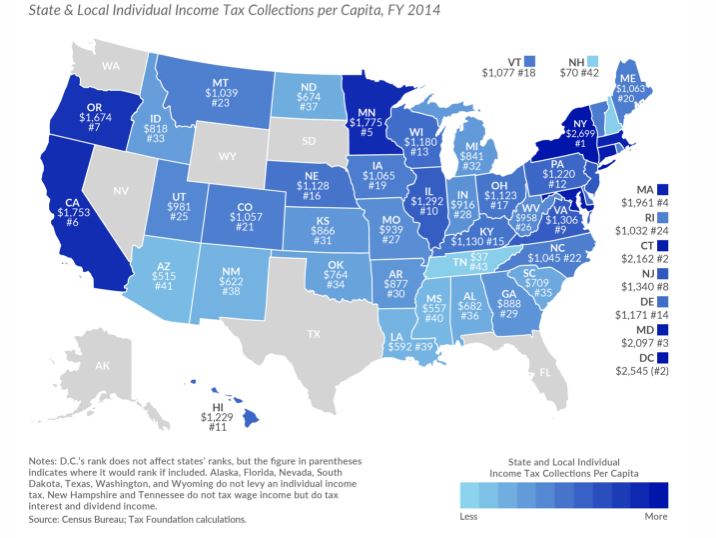

The Individual State Income Tax Rate For Every State For 2016 Chart Atlanta Business Chronicle

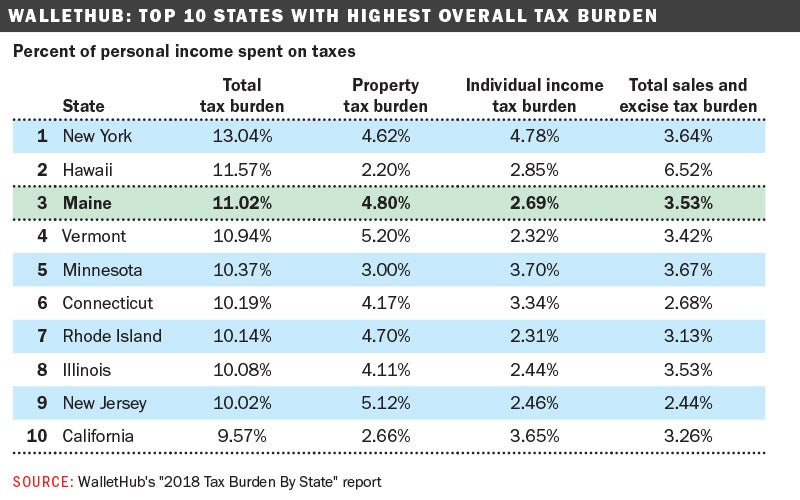

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

How Do State And Local Property Taxes Work Tax Policy Center

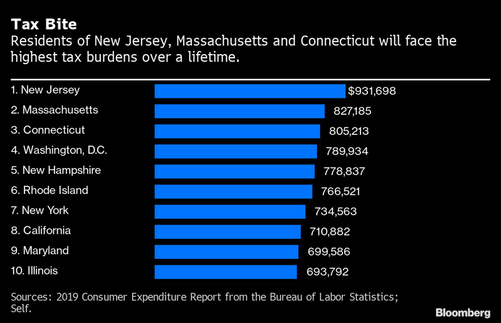

New Jersey Taxes Newjerseyalmanac Com

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

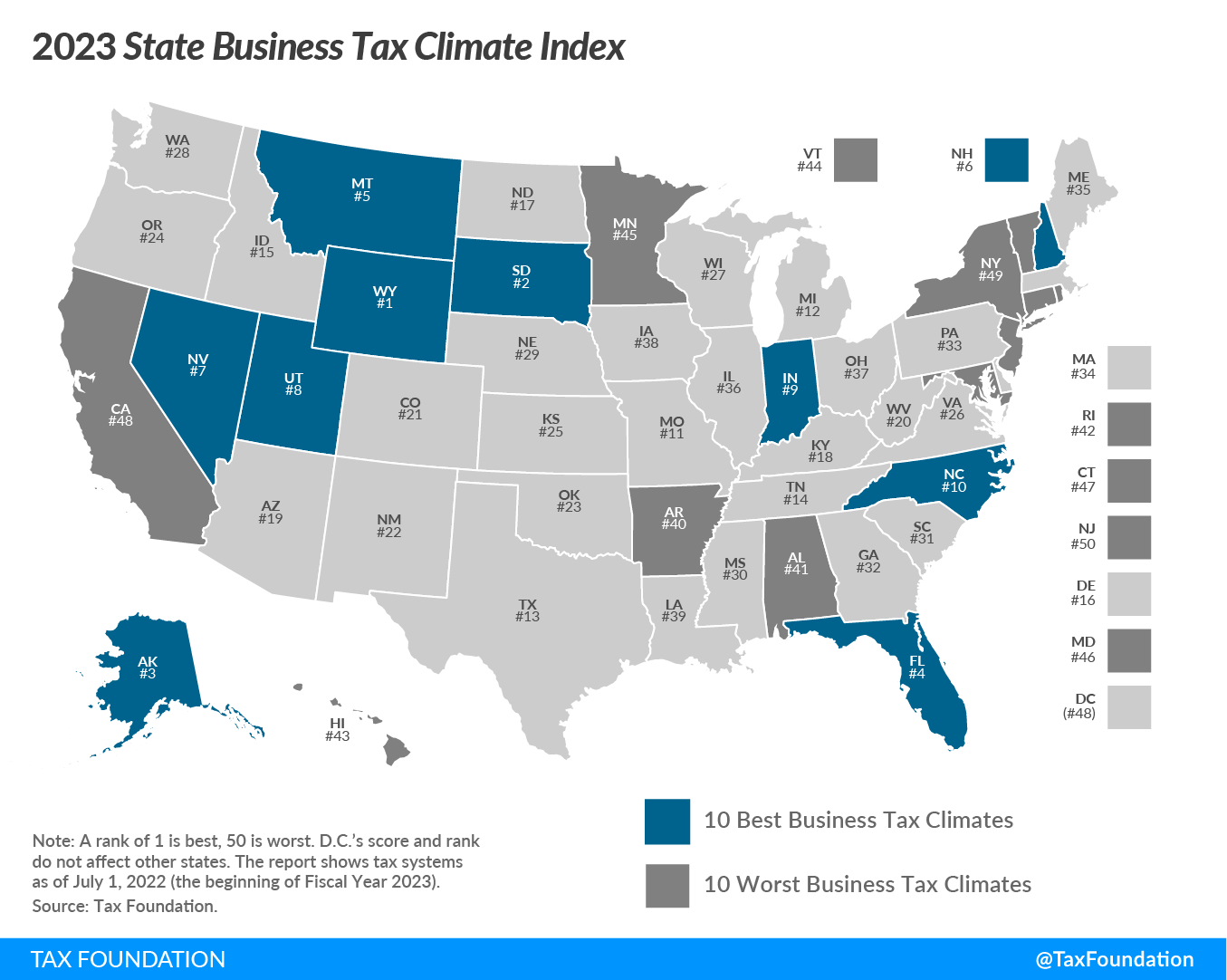

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

R I State And Local Income Tax Per Capita 2nd Lowest In New England

State Income Tax Rates What They Are How They Work Nerdwallet

Seven Things To Know About The R I House Finance Budget The Boston Globe

Rhode Island Tax Brackets And Rates 2022 Tax Rate Info

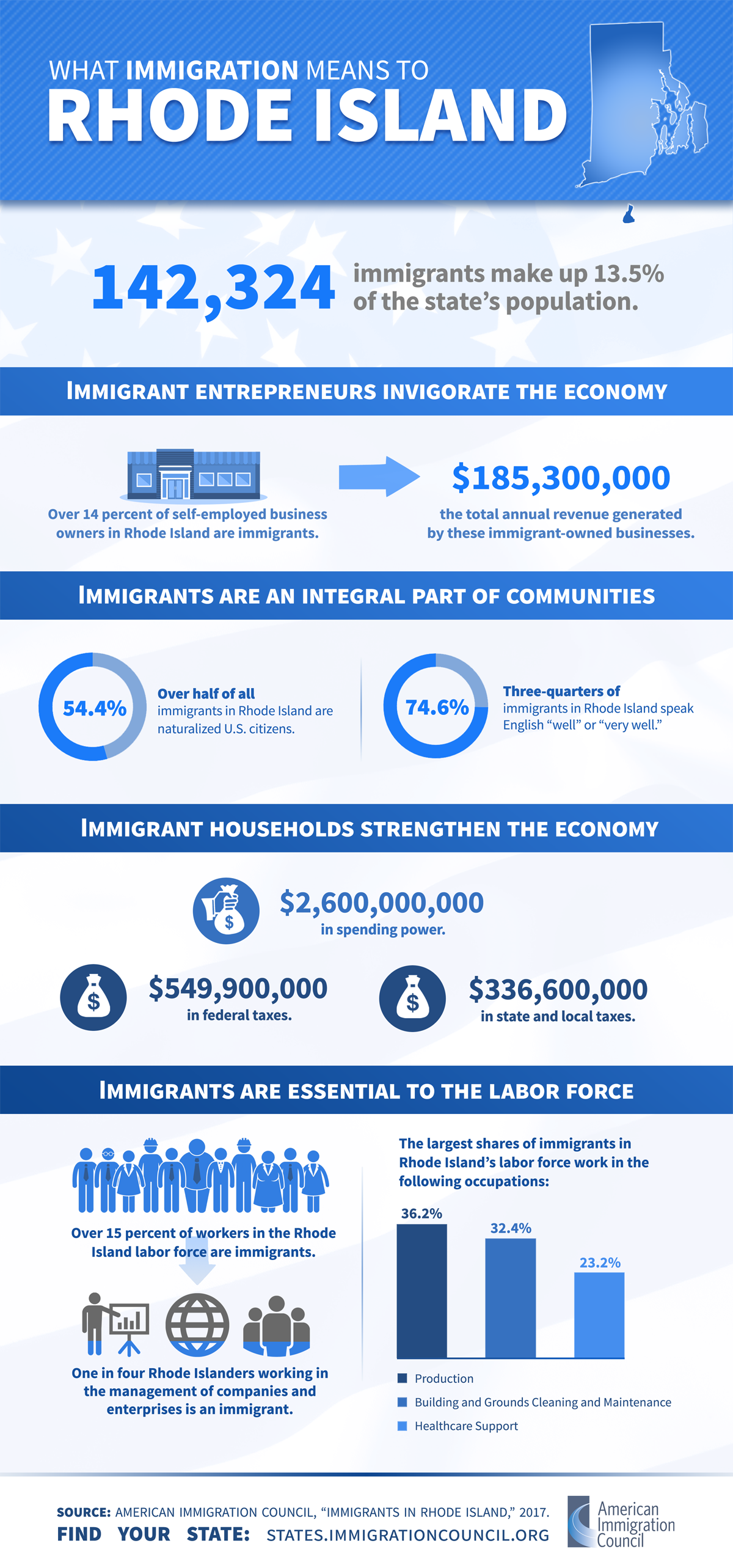

Immigrants In Rhode Island American Immigration Council

State Income Taxes Updated For 2019 On Total Moneytree Software

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com